Thurber Quote For This Millenium

Man is flying too fast for a world that is round. Soon he will catch up with himself in a great rear end collision. –James Thurber

Life and Thoughts in Zion Canyon

Man is flying too fast for a world that is round. Soon he will catch up with himself in a great rear end collision. –James Thurber

Hey folks,

As much as I am a fan of Obama’s message of the power of Hope, to be honest, I am troubled, and worried, and not just about the looney teabaggers and Dick Armey’s xenophobic brown-shirts. Maybe it’s because last year I read John Kenneth Galbraith’s “The Great Depression”, and have now just finished John Steinbeck’s “The Grapes of Wrath”, and all that talk about collapse amidst economist assertions that “The Fundamentals of the Economy are Sound”, and all the folks leaving their homes and farms and hitting the road got me into a bit of a funk.

But I don’t think so. There have been times lately when I’ve had the feeling that we are all just like the poor coyote in the “Road Runner” cartoons, and have just run off the road at the top of the mesa and as we speak are in that surreal span of ten or twenty seconds it takes for the coyote to realize that he has no ground to stand on, looks out to the audience with a doomed expression as he realizes that Gravity is Now in Effect.

But I don’t think so. There have been times lately when I’ve had the feeling that we are all just like the poor coyote in the “Road Runner” cartoons, and have just run off the road at the top of the mesa and as we speak are in that surreal span of ten or twenty seconds it takes for the coyote to realize that he has no ground to stand on, looks out to the audience with a doomed expression as he realizes that Gravity is Now in Effect.

Okay, so everybody now seems to be saying that the economy is on the upswing, the stock market has been shooting up since March, and gold is now over a 1000 dollars an ounce because everyone thinks that all these dollars pumped into the economy will result in a decay of the value of the dollar with resulting price increases. The worst case that anyone on main street seems to be talking about is a Carter-level “stagflation” where prices would start going up but the economy would remain stagnant. And as the market continues its current rally the government continues to pump in more stimulus and we have “turned the corner.”

Hmm.

Am I the only one around here (besides Gigi and her “Housing Bubble Blog” friends) who still has a bad feeling that we might be heading for something much worse?

It’s hard to tell; it seems that on odd days I live in a world where we have hit the bottom, the market is turning around and the recovery is a big V for Victory, and then on even days we are in the same sucker’s rally of that occurred in the Great Depression, just before the market tanked. And during the weekend I straddle both worlds, and am only able to tell whether I am in the evil world or not by checking to see if Spock has a goatee.

It’s hard to tell; it seems that on odd days I live in a world where we have hit the bottom, the market is turning around and the recovery is a big V for Victory, and then on even days we are in the same sucker’s rally of that occurred in the Great Depression, just before the market tanked. And during the weekend I straddle both worlds, and am only able to tell whether I am in the evil world or not by checking to see if Spock has a goatee.

Anyway, here’s a scrapbook of articles that I’ve been assembling over the last year or two — and many of which are from just last week.

Just thought I’d share the misery…

Part I The Big Picture: collapse of the debt-inflation bubble still in progress

The Start of It All: Gigi showed me this 2007 Credit-Suisse report that ultimately prompted me to move my 401K money out of stocks and into cash just before the market crashed. I have to take this report seriously as it saved me hundreds of thousands of dollars in retirement account. To this day my 401K remains in cash.

Page 47 of that report has this now-famous graph, which I have annotated for your convenience (click to expand):

If I read this report and graph correctly, so far we have only weathered the first “Katrina” storm of Subprime, and are only now entering the Rita of Alt-A and Option ARMs. Even Prime ARM’s should be considered at risk, given that many of those folks also lost their jobs this past year.

Some Wonky Econ Talk

Back in the old days, I always thought that “inflation” and “price increases” were synonymous. Eventually it was explained to me that “inflation” refers only to the increase in the money supply, either by literally printing dollars or extending credit to banks — which is pretty much the same thing. What the doom-sayers have been explaining lately is that even though prices have been fairly constant this past decade, we have actually undergone a huge inflation of the money supply through the extension of very cheap credit — made even cheaper by hiding or obscuring the true risk in bundled securitized packages. Now that these highly risky debts have all started to go sour, we really have no choice but allow all the bad debt to go away — and with it all of those dollars that were manufactured to back the loan in the first place.

In other words, the current crisis is a problem of too much bad money, and the only way to cure the problem is to make the money go away, which is to say Deflation. Another way to think about it is, all of the current bad debt (toxic assets as well as more bad news to come) are negative dollars, or “anti-dollars” in the current economy. And the reason that all of this new money being pumped into the economy by the stimulus package is not and will not result in price increases is that those new dollars are not chasing goods and services: they are being used to fill the holes created by the “anti dollars”. People aren’t going on spending sprees, they are saving, and paying down debt.

I read an item from McClatchy news recently about how Commercial Real Estate is considered the next threat. This is a real problem. It’s not so visible out here in Utah, but during our visit to Long Beach last week I saw a lot of empty buildings, including many that were old, long-time concerns, such as a lamp store on PCH that must have been there since the 50’s. With the current downturn, and nobody buying stuff, who is going to be leasing all these huge empty commercial properties in the next few years ?

So, this next economic storm could be a foreclosure Rita plus a Hurricane Camille.

Am I missing something?

Part II What US Recovery? What Inflation?

The Consumer Confidence index is holding steady at *negative* 216, meaning most people are still gloomy about present and future. (I know I am; how about you?) Most people are increasing their savings, and are reluctant to spend money, in an American economy which is based on domestic consumer activity, not export. Can you say “Paradox of Thrift” ?

Next: The Federal Reserve Bank of San Francisco issued a report earlier this year giving odds of 85% chance of Deflation in 2010.

The only prices I’ve seen edge up occasionally lately have been oil, but here is news of further downward pressure on oil. So I am very dubious. Who uses their car anymore, unless they have to? Most big companies that I know of (including mine) have been cutting way back on business travel, in favor of teleconferencing. As seen below, the big cargo ships are staying in port, so other than the Russian oligarchs with their new Hummers, who else is burning all this oil?

Part III: Deflation and/or Economic Contraction Worldwide

Sure doesn’t look like there is any other country in the world that going to be able to save our bacon, either. I ran a few google searches on the terms “inflation” and “deflation”, and paired each with a long list of countries. The bottom line is, there really aren’t too many countries that are seeing much inflation right now. Let’s go through a short version of this list, in no particular order:

Even Zimbabwe, which was going through a sextillion-percent hyperinflation, is no longer doing so. This is because they finally gave up on their own currency and (as of April of 2009) only use foreign currencies for exchange, such as US dollars. Somehow I don’t think that is really such a good thing, and it certainly doesn’t do us much good, as increased demand for dollars only increases their value and buying power (deflation).

International Trade

A while back Gigi directed my attention to this little-known but important thing called The Baltic Dry Index, which measures prices and demand for those large container ships used in international trade. It is considered a leading indicator of future global trends, and it remains down. Not much shipping going on across the sea in those big container ships, many of which are now parked and dormant in Singapore. Not much trade going on anywhere, worldwide.

Oh, well, at least we still have our health, right?

Other Threats to Recovery

More cheery news; H1N1: Could Flu Pandemic trigger deflation?

I really look forward to someone talking me out of this bad mood that I’m in. And I really, really look forward to being proved wrong in the coming year, and will be more than happy to say that I was wrong, and will buy you all a beer and clink glasses over what turned to be just me worrying a lot about nothing.

Here’s to the power of Hope. Ching-ching.

“Real poetry,” said the Haiku poet Basho, “is to lead a beautiful life. To live poetry is better than to write it.”

The months of April, May and June have already passed and — writing now from the red-rock deserts of Utah — the lush green world of our life in the Connecticut woods has begun to fade from recent memory. Even our spring road trip down through Ohio, Kentucky, Texas, New Mexico and on up to Utah has become a blur which only comes back into focus after looking through our photo archives and journals.

I had so much I wanted to write about over those last few months, but life events and packing and the economy and all that seemed to steal away the moments in the morning when I would be able to just to sit down gather my thoughts and photo albums and make sense of the things, in a form fit for public consumption.

There was the trip to Washington DC, where Gigi finally got to overdose on history and the cherry blossoms were in full bloom. The day trip out to West Cornwall in search of the old Colonial house that the humorist James Thurber lived in during his later years. The weekend in Greenwich Village, attending a three-day “cheese bootcamp” at Murray’s Cheese Shop. The final melting of snow, the explosion of flowers everywhere, the return of the rabbits and chipmunks, the journey up through New Hampshire to the land of “Foxbridge” where my novel takes place. and so much more.

When we first arrived in South Glastonbury, Connecticut I started a journal and over the next ten months, no matter what else was going on, I almost always took the time to put in an entry, however long or short, recording the date, the temperature, expected weather, and whatever events I cared to note from the preceding day. In lieu of any other tributes, here are the entries from the last week of that journal:

Wednesday, May 13, 2009

Sunny, Cold 38 degrees. Sun expected all Day.

Last minute things to do. Going to the Peabody Museum one last time so Gigi can look at the exhibit of “sacred stones” used in ancient Judaic traditions. One last pizza night, fill up the bird feeder on last time, visit with our friends Rich and Amy. Replace a few things we have broken.

Have I learned anything while I was here? We shall see. My eyes and ears were open, perhaps more often than in my California days, when the main goal was to shut things out with sunglasses and headphones.

The seasons have their own character, at times subtle in their changes, while at other times abrupt, with morning Summertime sun followed with an afternoon blizzard, and a Ginkgo tree that dropped its leaves in an hour-long shower. We arrived here in the deep green of summer, and now leave in the prima vera of Spring. Everything is a circle.

The old Mr. Rose, who owned the berry farm, died while we were here, and his son is running the place for now. The farmer died, but the farm continues. A mouse died on my watch, but the rivers still flow by the cove where he now rests.

This year has been variations on a theme of Solitude, punctuated by occasional ventures into the town-village, or the visits by out-of-towners, or invasions by flocks of wild turkeys.

I’ve learned that I could live like this, and that we have enough within ourselves to keep amused and busy. And so we shall, somewhere.

It has been a magic year. The world is filled with wonders.

Thursday, May 14, 2009

Cloudy, Cool 55 degrees. Thunderstorms later.

The farming machinery was running late yesterday. To be a farmer, it seems it has to be your life. There is no such thing as “after work,” or extra-curricular activity.

Long list of things to do before we go. Must keep my promise to donate to the Mark Twain House. I would like to think that upon my departure, Connecticut was left in slightly better shape than it was on my arrival.

I for one am certainly better off for the stay.

Friday, May 15, 2009

Cloudy, cool 61 degrees. More clouds later

This journal, like our stay here in Connecticut, is drawing to a close. Feeling a sense of regret, of things left undone, as at the end of one’s life when there is still so much left to do. A life well-lived, it seems, always ends in mid-sentence.

But have we learned nothing from our stay here, in the woods, next to a blueberry farm where the Starlings are due back any day, and the ten o’clock rabbit now has young apprentices in tow?

The seasons teach us that everything in life is a circle, and that every end a beginning, every death an illusion, if you do not also see the life that follows, as Winter never fails to turn into Spring.

Sunday, May 17, 2009

Cloudy, cool 55 degrees.

The chipmunks are back. Good to see them running about before we go.

Went down to the Peabody Museum yesterday and while down there realized that we had not yet made it over to the Gillette Castle, formerly owned by a stage actor famous for his portrayal of Sherlock Holmes, and who first used the line “Elementary, my dear fellow”.

We went through the woods to get there, stopping at the town of Chester and taking a ferry boat ride across the Connecticut river. Worth the trip.

Tuesday, May 19, 2009

Sunny, Cold 34 degrees. Warmer later

Almost finished packing. Once again we are living out of suitcases. Once again a long road is our future, our next home beyond the horizon, and across the Great Divide. Oblivious to all of this metaphor, the two squirrels chase each other around and around the base of the Ginkgo tree outside, the ten o’clock rabbit prepares for his morning shift, and now there is a new bird in the trees — could it be a hatchling? — with a curious dolphin-like squeal.

The last frost of winter takes a nip at our heels this morning, perhaps to send us on our way. Or, perhaps, a gentle reminder from winter that the world-in-time is a circle, and that someday soon, it will be back.

Thursday, May 21 2009

Sunny, Warm 68 degrees. Hot later

A robin has set up a nest on the front porch wreath. One blue egg fell out, but there are three more for the birds to attend.

The movers have come and gone and our car is packed. Within the hour we too will be gone.

Farewell, Blueberry Lane. Farewell, Connecticut. You were not always kind to us, perhaps, but you and your birds and your seasons and your people were cut from whole cloth of an honest weave seldom now seen, an experience worthwhile and not soon forgotten.

And for all of that, I thank you.

Writing from Utah, enroute to Connecticut. We actually did it. We put most of our stuff in a Pod, and what didn’t go in the Pod went into the car, and everything else was given away or tossed.

Our home life is now about boxes and packing, and getting rid of junk. If it won’t fit into our car on our roadtrip to Connecticut, it is going into long-term storage. If it is not worth storing, we are either giving it away or tossing it out.

It is just now sinking in to our friends in Southern California that we are really going to be moving out. For good, most likely. Time is short; in less than a month we will be on the road and heading into the unknown. Economic news is grim. Global warming with its storms and droughts loom metaphorically on the horizon, if not literally on the road ahead. It is a good time to be travelling light, agile and quick on our feet. The fewer posessions to bog you down, these days, the better.

“To lead an empty life, fill it up with things” — H. D. Thoreau.

Looks like we are heading out to Utah… by way of Connecticut. It is looking more and more like we will want to wait one more year before submitting new bids. So, my thinking is, given that Gigi can write her thesis anywhere and I can telecommute, why not take advantage of this time between California and Utah and go somewhere else in the world? We looked around at a lot of places, but given that we wanted a place

the Connecticut area seemed about right. We looked at a couple different places in the sabbatical homes website, and finally decided on renting a place in Glastonbury, near a blueberry farm. We expect to be there for nine months, after which we plan on heading back west to Utah.

And someday… Springdale.

As Gigi’s buddies on the housing bubble blog predicted, the whole subprime mess has gone to Helena Handbasket, and the median price of a home in the US has dropped for the first time on record. Nervous congress-folk are making noises and passing bills that will make it seem like they are doing something to rescue fools from the consequences of their own actions but the bottom line is that a whole lot of people were fooled (by others or themselves) into thinking they could buy a Maserati house on a Yugo income by playing one great big Ponzi scheme in the real estate/refinance/property flipping/equity loan/ universe. Short of divine intervention, a lot of very unhappy foolish people will be out of a home, out of work, out of credit, out of luck. Recession is all but certain, depression a possibility.

It doesn’t get much better than this.

The housing bubble has burst and new and used home sales have tanked. Interest rates remain at historically low levels, and will probably be held at that point by the Fed for some time, even in the event of new stagflation.

The only thing left on our wish list is for the cost of construction material (lumber, concrete, steel, stone, copper) to come down. Lumber has already gone into decline with the collapse of the residential construction, but the other materials have remained under high demand in the commercial construction business.

The 800 pound gorilla in the room is China, which has been eating up all the concrete and steel on the planet the last several years. A lot of this is simply a consequence of a former third-world communist country discovering capitalism and the industrial revolution. At their current rate they are somewhere in the nineteenth century, and robber-barons (with Communist membership cards) are buying limousines and there is a lack of regulatory discipline that would make George Bush jealous. But within a year or two, China will likely also pass through their own 1929, and eventually the anti-materialism backlash of the 60’s and the ecology movement of the 70’s will bring some maturity to their accelerated adolescence.

In the immediate future, however, what has been driving a substantial portion of the Chinese construction demand over the last four years has been the 2008 Olympics in Beijing. In addition to the main stadium and the huge new airport, a good portion of the city has been torn down and rebuilt from scratch, all of which requires a lot of construction material. If they stay on schedule, most of this construction must be completed this month so that they will have six months or so to get the “bugs” out of the huge construction projects, and to bring the air-pollution levels down to the point that the participants do not keel over from smoke asphyxiation.

Our plans remain to head out to Utah this summer and find a house to rent in Cedar City, 45 minutes from Springdale and just minutes from our architect. For the moment, we are content to wait and see how the construction market goes. In the ideal case, the economy will go south enough that we can afford to build our house for close to the original $125/sq foot estimate we got in 2004, but at any rate, with luck the economy will not be so bad that everybody is out of work and the dollar completely worthless. If it is, then we will both be out of a job along with half the country, and we’ll have a lot bigger problems to worry about than how to build a house. Like, say, how to locate the nearest soup-kitchen.

This is of course a totally selfish and unsympathetic attitude to take, regarding events that will cause much suffering. But it was pure and simple greed that was the cause of this whole housing bubble debacle in the first place, causing distortions in the market that rendered our own relatively sane and financially responsible approach to building a house of our own, economically unworkable. We knew we couldn’t afford to build a $700,000 house, and so, instead of getting a subprime adjustable like all the other idiots, we said NO. We are not shedding tears over the rise in foreclosures. The sound of high-fives echo down the hallway of our rental here in Long Beach. All we want to do is to build a nice modest little house in a place that we love, live our lives to the full in that house, and then die happy just before the polar caps turn our Utah property into beach-front. If this requires walking over the bloodied corpses of fools to do it, then so be it. No mercy, no quarter.

Happy Holidays Everyone!

To solidify some of the plans, we need to specify the appliances. After some field work and a trip to the Great Indoors, here’s what we’ve come up with (click on each named appliance for a link to that product’s description and specs):

We have not settled on the refrigerator. We want to move it from the side wall to the “wall of books”, directly behind the counter. The goal here is to minimize the “work triangle” between the sink, the range/stove and the refrigerator. To avoid going too deep through the wall we have been looking at the “cabinet” depth refrigerators.

Haven’t decided whether to go with chrome or brass finish. Everything comes in chrome, of course, but with the craftsman motif we will have some copper touches and the brass would go with that a bit better.

We’re hoping to get the plans into shape for submitting for bids in September or October. We’ll see how it goes…

It’s February, and we’ve already had a few heat waves. The housing bubble is

bursting nicely, and so it looks like it’s time to start working out the kinks in

our current design with Ray before resubmitting our plans for bids.

Here’s a starter list of topics we want to revisit with our plans:

Looks like 2006 has almost come and gone without a single posting, so I thought I bring things up to date. As we suspected, the housing boom became a bubble, and is now in the process of bursting.

From what we now know, it looks like our very first venture into the construction bidding process coincided with the largest spike in construction material and labor costs on record. We are in no rush, and are now just biding our time. Our current plans are to work with Ray on fine tuning our plans, and jump back into the bidding game around November or December of 2007, by which time we expect to be living in a substantially different environment.

For more entertaining news, check out one of Gigi’s favorite blogs, called The Housing Bubble Blog.

Stay tuned… Happy Holidays!

The website has been updated with a new version of

the WordPress software, which explains the change in

the look of the pages. Mostly security fixes.

Not much to report. We have three contractors working up bids

on our project. The initial bids were surprisingly high, twice what

any of us were expecting. The construction market is very hot

in Southwest Utah right now, which is part of the reason. In any

case, we will have to see if we can get the bids down further,

at least within our budget. If not, then our Plan B is to just wait

for the housing market to cool down a bit, and see how things go.

Stay tuned…

Gigi and I flew out to Illinois and were able to meet up with my folks out

there and return with the Ritter Block to be used as the cornerstone of the

house.

We stayed at Aunt Pat and Uncle Jerry’s house. My dad, Uncle Bob and

his wife Lillian also came up from Arkansas. We were given a tour of

Pinckneyville and surroundings, where my great grandather George lived,

along with his sons Charles (my granfather), Leo and Bill Ritter, my father Don,

and a lot of other Ritters. We also dropped by Aunt Eunice’s house (Leo’s wife),

who showed us through her museum and gave us a history lesson of the Ritters

here in southern Illinois.

Here is a picture of two Ritter blocks.

The big block is 23 3/4″ long by 7 1/2″ High by 7 3/4″ Deep. At the deepest point it is 8 3/4″, due to the facade on the front.. Weighs 92 1/2 lbs. The small block is 11 3/4″ Long by 7 1/2″ High by 7 3/4″ Deep.. It, too, at the deepest point is 8 3/4″ due to the facade on the front.. It weighs 50 1/2 lbs.

The observant reader will have noticed that the title of this website is now “A House Named Anthem”. The house is named after a song called “Anthem”, that was written by Lyra, a classical guitar and violin duet. The duet consists of Maryanne Kremer-Ames, who plays the classical guitar, and Allen Ames, her husband, who plays both violin and the violyra.

We first heard Lyra’s music while we were traveling through Sedona, and

stayed at the Briar Patch Inn bed and breakfast. We were sitting out by

Oak creek, eating our breakfast, and Lyra was playing a beautiful piece that

we had never heard before.

When we asked them about the piece, they said that it was titled “Anthem”, and

that it was inspired by the beauty of the Sedona area. We liked the piece, and

the area, so much that when we got married it was at that same Bed and Breakfast,

and we invited Lyra to play at our wedding. The name of the piece they played during

the ceremony was “Anthem”.

We later found out that Allen and Maryanne were married at the Briar Patch Inn,

ten years previously.

The fact that “Anthem” is also the title of Ayn Rand’s short novel, is not entirely coincidental, either.

The Springdale Planning Council gave their approval for the

building of our house on Anasazi Plateau !

Ray Gardner gave a presentation on Feb 15 that addressed some

of their concerns about the large windows, and the nighttime light

pollution. Here’s a sampling of the presentation:

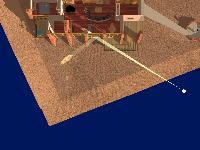

Nightime view of House from South

Nightime view of House from South

Sunlight at Equinox in Morning

Sunlight at Equinox in Morning

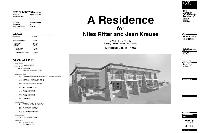

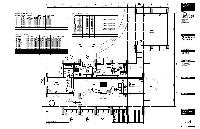

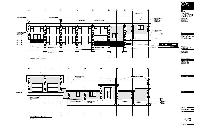

Here are the plans that we will be presenting to the Springdale Town Planning Commission

on February 15, 2005. Both Ray Gardner and our builder Jason Campbell will be

attending. We also plan on meeting with the developer, Milo McCowan, prior to the

town meeting.

The Title Page ( Original PDF Version )

The Title Page ( Original PDF Version )

The Site Plan (Original PDF Version)

The Site Plan (Original PDF Version)

The Floor Plan – Window Schedule (Original PDF Version)

The Floor Plan – Window Schedule (Original PDF Version)

North Elevation (Original PDF Version)

North Elevation (Original PDF Version)

West Elevation (Original PDF Version)

West Elevation (Original PDF Version)

Cross Sections (Original PDF Version)

Cross Sections (Original PDF Version)

Here are some possible stone samples, that our builder Jason Campbell

has provided. The first is local sandstone (I think it is from the Moenkapi formation),

the second is limestone, and the third is called “moss stone”, and has some

natural lichen growing on it. We are leaning toward the first two types.

Here is a PDF version of the latestHouse Plans from Ray. In this version, the cooktop (which is now a six-unit Jenn-Air downdraft model) has been moved back off the island and back to the counter, the oven centered in the island, the sink moved over to the western side of the counter, and the bar section shrunk down a bit.

I think we’re mostly done with the plan-level stuff. Time to work on choices of stone and colors…